Euro and pound will be determined with direction

Eurozone

The euro area economy continues to expand at a steady pace, GDP growth in Q3 was 0.6%, at an annual rate of 2.6%, preliminary data was revised upwards, which is consistent with the overall economic trend.

Growth is primarily due to increased investment and exports. Despite the fact that household expenditures have decreased somewhat, the general level of optimism continues to improve, as indicated by the recent reports of ZEW and IFO.

On Wednesday, a report on industrial production will be released, on Thursday - PMI Markit index. This will be the latest data ahead of the ECB meeting, they will help to predict the overall tone of the commentary and the position of Mario Draghi at a subsequent press conference.

On Thursday, investors do not expect the ECB to decide to make any concrete steps, since there is no reason for this yet. However, forecasts for economic growth and inflation will be updated upwards, as indicated by both growing business activity in recent months and rising oil prices.

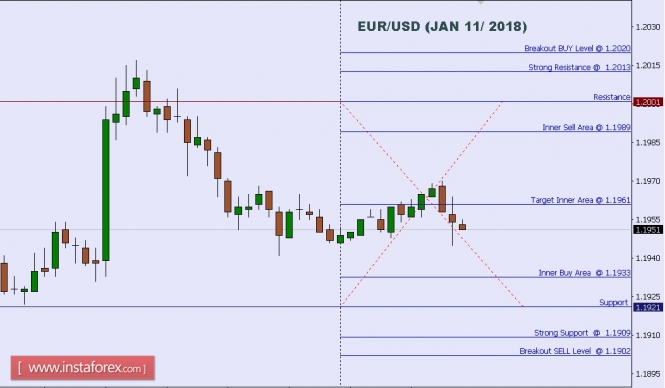

The euro as a reaction to the meeting of the FOMC may decline to a support level of 1.1670, growth is limited to the level of 1.1880.

United Kingdom

The pound on the eve of the meeting of the Bank of England on December 14 is seent to be positive. According to Halifax, housing prices have stabilized after more than a year of decline and activity in the construction sector decreased. The inflation forecast published by the Bank of England rose from 2.8% to 2.9%, the trade deficit instead of expanding has unexpectedly remained virtually unchanged. Sufficiently, the industry appears much better, which was clearly facilitated by the protracted period of the weak pound, which supported the export industries.

The industrial sector is growing for the sixth month in a row, on an annualized basis, growth was 3.9%, which is higher than expected

The National Institute for Economic and Social Research (NIESR) reports that, according to their calculations, UK GDP growth for the last 3 months was 0.5%, which exceeds both the indicators of the beginning of the year and 0.4% in the third quarter.

These factors increase the likelihood that the Bank of England will continue to gradually raise rates, and will also contribute to the growth of the pound. Although at the next meeting, the Bank of England will not raise the bid, the general trend is in favor of an increase, which is clearly a bullish factor for the pound.

On Friday, there was news that the UK and the EU agreed on three key points in the first phase of the Brexit talks. The border between Ireland and Northern Ireland was agreed upon, migration policies concerning the rights of EU citizens in the UK, and, most importantly, London's payment for the withdrawal from the EU. Thus, the first phase of negotiations is completed, and at the EU meeting on December 14, it will be possible to announce the progress achieved. This news will strengthen the positions of both the euro and pound.

The pound, nevertheless, will still be under pressure, since there are no serious internal drivers in the coming week. Presumably, a decline towards 1.3250 as an intermediate target and 1.2850 as a long-term goal.

Oil

China, which is the world's major oil consumer, supported the growing trend on Friday, posting significantly higher than expected trade balance data in November. Crude oil imports increased by 19.37% in November, demand remains firmly high, which, combined with a number of restrictive measures by OPEC + and significant financial losses of shale companies in the US, contribute to the formation of a stable demand against the backdrop of stable production in the context of the price war with OPEC. Together, these factors support oil, which allows us to predict a breakthrough of resistance at 63.50 for Brent in the short term.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex