I read you posts and find them very useful. I want to start trading stocks now, can you share some tips or another useful information about them? I will work with AvaTrade broker https://www.avatrade.co.za/cfd-trading/stocks I learned all education materials here. What brokers do you use? I will be grateful for any advice.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wave Analysis from InstaForex

- Thread starter InstaForex Gertrude

- Start date

IFX Yvonne

Member

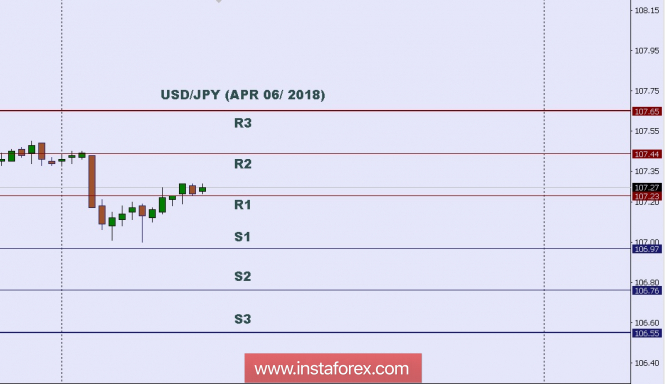

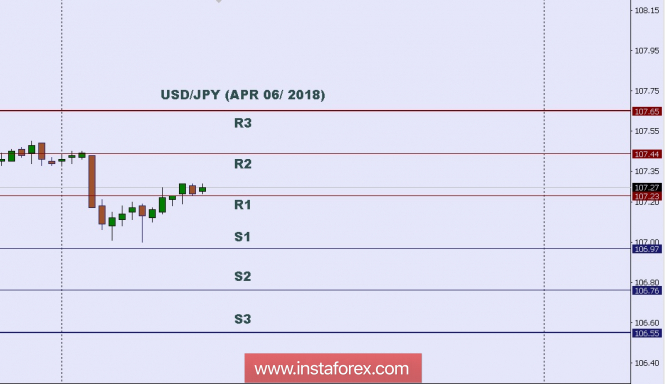

Intraday level for USD/JPY, April 06, 2018

In Asia, Japan will release the Leading Indicators, Average Cash Earnings y/y, and Household Spending y/y data, and the US will release some Economic Data, such as Consumer Credit m/m, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m. So, there is a probability the USD/JPY will move with a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 107.65.

Resistance. 2: 107.44.

Resistance. 1: 107.23.

Support. 1: 106.97.

Support. 2: 106.76.

Support. 3: 106.55.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In Asia, Japan will release the Leading Indicators, Average Cash Earnings y/y, and Household Spending y/y data, and the US will release some Economic Data, such as Consumer Credit m/m, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m. So, there is a probability the USD/JPY will move with a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 107.65.

Resistance. 2: 107.44.

Resistance. 1: 107.23.

Support. 1: 106.97.

Support. 2: 106.76.

Support. 3: 106.55.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

IFX Yvonne

Member

I read you posts and find them very useful. I want to start trading stocks now, can you share some tips or another useful information about them? I will work with AvaTrade broker https://www.avatrade.co.za/cfd-trading/stocks I learned all education materials here. What brokers do you use? I will be grateful for any advice.

Hi Filler, Our company provides an educational trading tutorials which you can find on this link. If you want to receive the Forex analytics newsletter to you email, you may subscribe here.

Last edited:

InstaForex Gertrude

Active member

Sensation from North Korea

AUD / USD

On Friday, the Australian dollar did not give rise to the speculative sentiment of the European and American traders and was fundamentally declined by 10 points on the general unfavorable background of foreign markets. Oil lost in price slightly more than 2%, iron ore -0.08%, copper -0.7%.

This morning, investors were satisfied with the growth in the construction sector activity from AIG in the March assessment, the growth came in from 56.0 to 57.2 points. The NAB business confidence index will be release tomorrow, as the March forecast showed results of 12 against 9 in February. Also, the stock markets of the APR failed to grow badly today despite the Friday drop in the US market, with the Nikkei 225 + 0.68%, S & P / ASX 200 + 0.37%, and China A50 + 0.26%. The possible optimism is related to Kim Jong-un's statement about the readiness to test the nuclear weapons and to conduct a denuclearization of the Korean Peninsula. The "Australian" currency could possibly grow in the range of 0.7760 / 75.

* The presented market analysis is informative and does not constitute a guide to the transaction.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

AUD / USD

On Friday, the Australian dollar did not give rise to the speculative sentiment of the European and American traders and was fundamentally declined by 10 points on the general unfavorable background of foreign markets. Oil lost in price slightly more than 2%, iron ore -0.08%, copper -0.7%.

This morning, investors were satisfied with the growth in the construction sector activity from AIG in the March assessment, the growth came in from 56.0 to 57.2 points. The NAB business confidence index will be release tomorrow, as the March forecast showed results of 12 against 9 in February. Also, the stock markets of the APR failed to grow badly today despite the Friday drop in the US market, with the Nikkei 225 + 0.68%, S & P / ASX 200 + 0.37%, and China A50 + 0.26%. The possible optimism is related to Kim Jong-un's statement about the readiness to test the nuclear weapons and to conduct a denuclearization of the Korean Peninsula. The "Australian" currency could possibly grow in the range of 0.7760 / 75.

* The presented market analysis is informative and does not constitute a guide to the transaction.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Producer prices in the US have grown significantly

Data released in the first half of the day, slightly supported the European currency, which formed a new uptrend yesterday.

Positively, euro buyers responded to the growth of industrial production in France and Italy in February of this year after more than a sharp decline in the beginning of the year.

According to the report of the statistics agency, industrial production in France in February this year grew by just 1.2% after falling 1.8% in January. Economists predicted that industrial production will grow by 1.3%.

In Italy, the indicator that was mentioned above also added 1.0% after a drop of 1.8% in January of this year. Economists were less upbeat and expected a decline in production in February by 0.5%. Compared to the same period in 2017, the industry in Italy grew by 2.5%, while economists were confident in growth of 4.8%.

The euro has grown well after weak data, which pointed to a decrease in the optimism level of the leaders of small companies in the US in March this year. It is logical to assume that the trade war unleashed by the White House administration negatively affects entrepreneurs who are expecting an improvement of the state of the economy and further develop their business.

According to the report of the National Federation of Independent Business, the optimism index of small business in March dropped to 104.7 points against 107.6 points in February. As noted in the NFIB, despite the decline in the overall index, hiring of employees and spending on the acquisition of new real estate remain at high levels.

Without attention, buyers of the US dollar left the fact that producer prices in the US in March of this year showed a significant growth, which will necessarily create a good overall inflationary pressure in the US economy, as expected by the Federal Reserve.

According to the US Department of Labor, the producer price index rose by 0.3% in March compared to the previous month. The tank index, which does not take into account volatile categories, especially energy prices, rose by 0.3% in March, compared with the previous month.

Economists had expected that the overall index would show an increase of 0.1%, and the base index will grow by 0.2%. Compared to the same period of the previous year, the overall index rose in March by 3.0%, the index excluding food and energy increased by 2.7%.

The British pound disregarded the speech of the representative of the Bank of England Andy Haldane, who said that monetary policy had not had a significant impact on income inequality in the UK. However, without stimulation, unemployment would be higher and GDP would be lower.

So far, demand for the pound remains on the back of a lack of new conversations related to Brexit. UK economic indicators also point to a positive scenario for the economy, which could lead to further hikes in interest rates by the Bank of England. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Data released in the first half of the day, slightly supported the European currency, which formed a new uptrend yesterday.

Positively, euro buyers responded to the growth of industrial production in France and Italy in February of this year after more than a sharp decline in the beginning of the year.

According to the report of the statistics agency, industrial production in France in February this year grew by just 1.2% after falling 1.8% in January. Economists predicted that industrial production will grow by 1.3%.

In Italy, the indicator that was mentioned above also added 1.0% after a drop of 1.8% in January of this year. Economists were less upbeat and expected a decline in production in February by 0.5%. Compared to the same period in 2017, the industry in Italy grew by 2.5%, while economists were confident in growth of 4.8%.

The euro has grown well after weak data, which pointed to a decrease in the optimism level of the leaders of small companies in the US in March this year. It is logical to assume that the trade war unleashed by the White House administration negatively affects entrepreneurs who are expecting an improvement of the state of the economy and further develop their business.

According to the report of the National Federation of Independent Business, the optimism index of small business in March dropped to 104.7 points against 107.6 points in February. As noted in the NFIB, despite the decline in the overall index, hiring of employees and spending on the acquisition of new real estate remain at high levels.

Without attention, buyers of the US dollar left the fact that producer prices in the US in March of this year showed a significant growth, which will necessarily create a good overall inflationary pressure in the US economy, as expected by the Federal Reserve.

According to the US Department of Labor, the producer price index rose by 0.3% in March compared to the previous month. The tank index, which does not take into account volatile categories, especially energy prices, rose by 0.3% in March, compared with the previous month.

Economists had expected that the overall index would show an increase of 0.1%, and the base index will grow by 0.2%. Compared to the same period of the previous year, the overall index rose in March by 3.0%, the index excluding food and energy increased by 2.7%.

The British pound disregarded the speech of the representative of the Bank of England Andy Haldane, who said that monetary policy had not had a significant impact on income inequality in the UK. However, without stimulation, unemployment would be higher and GDP would be lower.

So far, demand for the pound remains on the back of a lack of new conversations related to Brexit. UK economic indicators also point to a positive scenario for the economy, which could lead to further hikes in interest rates by the Bank of England. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Technical analysis: Intraday Level For EUR/USD, May 02, 2018

When the European market opens, some Economic Data will be released such as Unemployment Rate, Italian Prelim GDP q/q, Prelim Flash GDP q/q, Italian Monthly Unemployment Rate, Final Manufacturing PMI, Final Manufacturing PMI, French Final Manufacturing PMI, Italian Manufacturing PMI, and Spanish Manufacturing PMI. The US will release the Economic Data too, such as Federal Funds Rate, Crude Oil Inventories, and ADP Non-Farm Employment Change, so, amid the reports, EUR/USD will move in a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2050.

Strong Resistance:1.2043.

Original Resistance: 1.2031.

Inner Sell Area: 1.2019.

Target Inner Area: 1.1991.

Inner Buy Area: 1.1963.

Original Support: 1.1951.

Strong Support: 1.1939.

Breakout SELL Level: 1.1932.

Analysis are provided by InstaForex

When the European market opens, some Economic Data will be released such as Unemployment Rate, Italian Prelim GDP q/q, Prelim Flash GDP q/q, Italian Monthly Unemployment Rate, Final Manufacturing PMI, Final Manufacturing PMI, French Final Manufacturing PMI, Italian Manufacturing PMI, and Spanish Manufacturing PMI. The US will release the Economic Data too, such as Federal Funds Rate, Crude Oil Inventories, and ADP Non-Farm Employment Change, so, amid the reports, EUR/USD will move in a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2050.

Strong Resistance:1.2043.

Original Resistance: 1.2031.

Inner Sell Area: 1.2019.

Target Inner Area: 1.1991.

Inner Buy Area: 1.1963.

Original Support: 1.1951.

Strong Support: 1.1939.

Breakout SELL Level: 1.1932.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Gold tests advisor

The dollar rose from its knees and the yield of 10-year US Treasuries broke through a psychologically important mark of 3%, which made gold a whipping boy. The precious metal fell to the level of 4-month lows, and the market is discussing the prophetic forecast of Larry Kudlow. When assuming the post of chief economic advisor to the president, he recommended buying the US dollar and selling gold. By that time, and the case was in mid-March, the USD index lost about 8.6%, while the XAU/USD, by contrast, added 8.8%, so Kudlow's advice at best was puzzling. In fact, everything turned out differently. The Economic Adviser proved his professionalism. A great start, Larry!

Dynamics of gold and the US dollar

Someone perceived the success of the replacement Gary Cohen as an accident (once a year and a stick shoots), someone - a confirmation of the theory that markets are ruled by people from Washington, whether the Fed or the US administration. Much more important is another - the precious metal and the dollar continue to walk in pairs, although in different directions. The gold is traditionally perceived as a hedge against inflation, but always take into account the dynamics of real rates of the US debt market. The rapid growth in the yield of treasury bonds caused no less a blow to the positions of the "bulls" in the XAU/USD than the "greenback" who rose from the ashes. The precious metal is unable to compete with bonds because of its inability to pay dividends, so it fell into disgrace. Stocks of the world's largest specialized stock exchange fund SPDR Gold Trust fell to 866.77 tons, while XAU/USD prices fell to the lowest level since the end of December.

Gold as easily slid into the red zone from the beginning of the year, as it started to kick off. What can save it? Short-term - the absence of signals from the Fed on four hikes in the federal funds rate in 2018 and disappointing statistics on the US labor market for April. Mid-term - the restoration of the global economy after a disastrous first quarter. Do not be surprised that the safe-haven will respond positively to an improvement in the global appetite for risk. In fact, the scheme "overclocking the US economy - increasing the growth rate of global GDP - the normalization of monetary policy by central banks-competitors of the Fed" can cause a re-earn, which will lead to a weakening of the dollar and a return to interest in gold.

Investors should closely monitor the ability of the yield of 10-year US bonds to break the level of 3%, and gain a foothold above it. It does not work out - large accounts will begin to record profits on long positions in US currency.

The technically formed pattern of the "Broadening Wedge" pattern and the transformation of the "Shark" pattern into a 5-0 increase the risks of a pullback in the direction of 23.6%, 38.2% and 50% of the CD wave. Correction, as a rule, is used for selling, however, if bulls on gold manage to return quotes to the resistance at $1352 and $1359 per ounce, the risks of recovery of the upward trend will increase.т.

Gold, daily chart

Analysis are provided by InstaForex

The dollar rose from its knees and the yield of 10-year US Treasuries broke through a psychologically important mark of 3%, which made gold a whipping boy. The precious metal fell to the level of 4-month lows, and the market is discussing the prophetic forecast of Larry Kudlow. When assuming the post of chief economic advisor to the president, he recommended buying the US dollar and selling gold. By that time, and the case was in mid-March, the USD index lost about 8.6%, while the XAU/USD, by contrast, added 8.8%, so Kudlow's advice at best was puzzling. In fact, everything turned out differently. The Economic Adviser proved his professionalism. A great start, Larry!

Dynamics of gold and the US dollar

Someone perceived the success of the replacement Gary Cohen as an accident (once a year and a stick shoots), someone - a confirmation of the theory that markets are ruled by people from Washington, whether the Fed or the US administration. Much more important is another - the precious metal and the dollar continue to walk in pairs, although in different directions. The gold is traditionally perceived as a hedge against inflation, but always take into account the dynamics of real rates of the US debt market. The rapid growth in the yield of treasury bonds caused no less a blow to the positions of the "bulls" in the XAU/USD than the "greenback" who rose from the ashes. The precious metal is unable to compete with bonds because of its inability to pay dividends, so it fell into disgrace. Stocks of the world's largest specialized stock exchange fund SPDR Gold Trust fell to 866.77 tons, while XAU/USD prices fell to the lowest level since the end of December.

Gold as easily slid into the red zone from the beginning of the year, as it started to kick off. What can save it? Short-term - the absence of signals from the Fed on four hikes in the federal funds rate in 2018 and disappointing statistics on the US labor market for April. Mid-term - the restoration of the global economy after a disastrous first quarter. Do not be surprised that the safe-haven will respond positively to an improvement in the global appetite for risk. In fact, the scheme "overclocking the US economy - increasing the growth rate of global GDP - the normalization of monetary policy by central banks-competitors of the Fed" can cause a re-earn, which will lead to a weakening of the dollar and a return to interest in gold.

Investors should closely monitor the ability of the yield of 10-year US bonds to break the level of 3%, and gain a foothold above it. It does not work out - large accounts will begin to record profits on long positions in US currency.

The technically formed pattern of the "Broadening Wedge" pattern and the transformation of the "Shark" pattern into a 5-0 increase the risks of a pullback in the direction of 23.6%, 38.2% and 50% of the CD wave. Correction, as a rule, is used for selling, however, if bulls on gold manage to return quotes to the resistance at $1352 and $1359 per ounce, the risks of recovery of the upward trend will increase.т.

Gold, daily chart

Analysis are provided by InstaForex

IFX Yvonne

Member

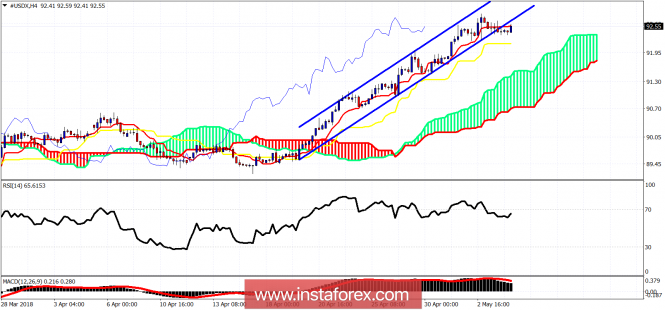

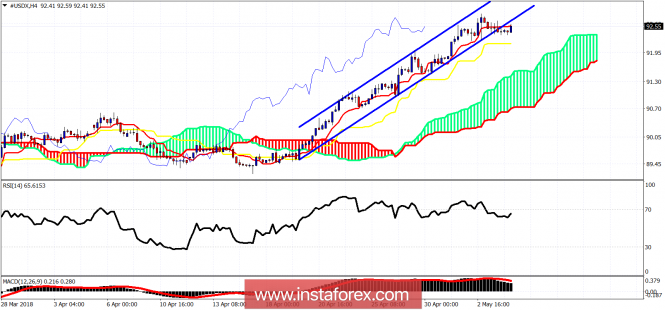

Technical analysis on USDX for May 4, 2018

The Dollar index has broken out of the bullish channel. Price has been giving bearish divergence signs in the RSI for the last few days while it was making higher highs and higher lows. With Non Farm Payrolls expected today, traders should be very cautious and wait to act until after the announcement.

Blue lines - bullish channel

The Dollar index above the Ichimoku cloud. Trend remains bullish. However we have two warning signs. The break below the channel and the bearish divergence in the RSI. Short-term support is at 92.15 and next at 91.40. I expect a major trend reversal to occur today or early next week to the downside. I would not be buying the index around current levels but look for selling.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The Dollar index has broken out of the bullish channel. Price has been giving bearish divergence signs in the RSI for the last few days while it was making higher highs and higher lows. With Non Farm Payrolls expected today, traders should be very cautious and wait to act until after the announcement.

Blue lines - bullish channel

The Dollar index above the Ichimoku cloud. Trend remains bullish. However we have two warning signs. The break below the channel and the bearish divergence in the RSI. Short-term support is at 92.15 and next at 91.40. I expect a major trend reversal to occur today or early next week to the downside. I would not be buying the index around current levels but look for selling.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaForex Gertrude

Active member

Pound keeps gunpowder dry

Looking at the dynamics of the British pound in the last two weeks, "bulls" are really sorry. Excessive euphoria after the announcement of the transition period between the UK and the EU and the "hawkish" speeches by representatives of the Bank of England allowed the GBP/USD pair to climb to a peak since the referendum on membership in the European Union. Many forecasters saw sterling at $1.45 and higher by the end of the year, but the reality turned out to be harsh. Disappointing statistics and a surprise from Mark Carney is a cold shower spilled on the heads of the pound fans. From the levels of the April highs, it lost about 6% of its value.

British tabloids love to criticize foreign players. Therefore, the speech of the Canadian nationality of Carney that BoE has other meetings to talk about raising the REPO rate was interpreted as cowardice. The subsequent negative from GDP for the first quarter and from business activity in April reduced the chances of a tightening of monetary policy from 90% to 10% in May. Is it possible to resist such a background sterling?

The dynamics of the likelihood of an increase in the REPO rate in May

The US dollar rose from the ashes to the fire. The US currency is attacking the entire front of the market due to the growth of the yield of treasury bonds and the large-scale winding up of record speculative net-euros. The slowdown of the eurozone's GDP affects the economy of the UK.

Is it worth to blame Mark Carney for cowardice? The departure of inflation from the 3% mark and the weak macroeconomic statistics on industrial production, retail sales, GDP and other indicators compel the Bank of England to keep its powder dry. The final touch was the release of data on business activity in the service sector, which accounts for about 80% of UK GDP. The purchasing managers' index rose from a 20-month low of 51.7 to 52.8 in March, but did not reach the forecasts of Bloomberg experts.

And yet BofA Merrill Lynch recommends its clients - "bears" - to be cautious. The Bank of England does not refrain from normalizing monetary policy, which, together with a reduction in political risks, should support the sterling. The National Institute of Economic and Social Research predicts that the REPO rate will be raised in August, and during the remainder of the year GDP growth will be about 1.7%.

Most likely, on May 10, Mark Carney and his colleagues will decide to retain the previous parameters of monetary policy, nevertheless the BoE head's emphasis on a strong labor market, including stable growth of average wages, can serve a good service to the pound's fans. When most sell sterling, the positive from the Central Bank is able to fool those who came in late to join the downward path of the GBP/USD.

Technically, reaching a target of 127.2% for the subsidiary "shark" pattern increases the risks of a pullback of the pair being analyzed in the direction of 1.37 and 1.383. The renewal of the May low will create the prerequisites for continuing the peak in the direction of the 88.6% target over the parent "shark" pattern.

GBP/USD, daily chart

Analysis are provided by InstaForex

Looking at the dynamics of the British pound in the last two weeks, "bulls" are really sorry. Excessive euphoria after the announcement of the transition period between the UK and the EU and the "hawkish" speeches by representatives of the Bank of England allowed the GBP/USD pair to climb to a peak since the referendum on membership in the European Union. Many forecasters saw sterling at $1.45 and higher by the end of the year, but the reality turned out to be harsh. Disappointing statistics and a surprise from Mark Carney is a cold shower spilled on the heads of the pound fans. From the levels of the April highs, it lost about 6% of its value.

British tabloids love to criticize foreign players. Therefore, the speech of the Canadian nationality of Carney that BoE has other meetings to talk about raising the REPO rate was interpreted as cowardice. The subsequent negative from GDP for the first quarter and from business activity in April reduced the chances of a tightening of monetary policy from 90% to 10% in May. Is it possible to resist such a background sterling?

The dynamics of the likelihood of an increase in the REPO rate in May

The US dollar rose from the ashes to the fire. The US currency is attacking the entire front of the market due to the growth of the yield of treasury bonds and the large-scale winding up of record speculative net-euros. The slowdown of the eurozone's GDP affects the economy of the UK.

Is it worth to blame Mark Carney for cowardice? The departure of inflation from the 3% mark and the weak macroeconomic statistics on industrial production, retail sales, GDP and other indicators compel the Bank of England to keep its powder dry. The final touch was the release of data on business activity in the service sector, which accounts for about 80% of UK GDP. The purchasing managers' index rose from a 20-month low of 51.7 to 52.8 in March, but did not reach the forecasts of Bloomberg experts.

And yet BofA Merrill Lynch recommends its clients - "bears" - to be cautious. The Bank of England does not refrain from normalizing monetary policy, which, together with a reduction in political risks, should support the sterling. The National Institute of Economic and Social Research predicts that the REPO rate will be raised in August, and during the remainder of the year GDP growth will be about 1.7%.

Most likely, on May 10, Mark Carney and his colleagues will decide to retain the previous parameters of monetary policy, nevertheless the BoE head's emphasis on a strong labor market, including stable growth of average wages, can serve a good service to the pound's fans. When most sell sterling, the positive from the Central Bank is able to fool those who came in late to join the downward path of the GBP/USD.

Technically, reaching a target of 127.2% for the subsidiary "shark" pattern increases the risks of a pullback of the pair being analyzed in the direction of 1.37 and 1.383. The renewal of the May low will create the prerequisites for continuing the peak in the direction of the 88.6% target over the parent "shark" pattern.

GBP/USD, daily chart

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Pound and the euro continue to fall

Despite good industrial production figures in Germany for March of this year, the European currency continued its decline against the US dollar and a number of other world currencies on Tuesday morning. The speech of the chairman of the Fed was taken by traders with a certain optimism. Although, Powell did not touch on the conditions of monetary policy but instead spoke more about its impact on other developed economies of the world.

According to the report of the Federal Bureau of Statistics of Germany, industrial production in March 2018 grew by 1.0% compared with February, while economists expected an increase of 0.8%. As stated in the report, the main reason for the growth was the increase in production of capital goods. Compared with March 2017, industrial production in Germany increased by 3.2%.

Good data from Germany, after the disastrous beginning of the year, instilled some optimism in investors, but, as we see on the EURUSD chart, this is not enough.

The morning speech by the Chairman of the Federal Reserve, Jerome Powell, had a positive effect on the quotes of the US dollar. Powell said that despite the Fed's repeated increase in rates since December 2015, financial conditions in the US have become less stringent, while monetary stimulus has had only a relatively limited impact on the flow of capital in emerging economies in recent years. He also noted that the Fed, as much as possible, clearly intends to talk about the prospects of politics in order to avoid unrest in the markets.

As for the technical picture of the EURUSD pair, the downtrend persists and so far there are no prerequisites for a reversal. The breakdown at the support level of 1.1890 opens up new prospects for updating the lows in the areas of 1.1830 and 1.1790. The main goal now will be the level of the minimum of December 12, 2017 which is the level of 1.1717.

The British pound grew reluctantly but returned to the lower boundary of the side channel, which also indicates the continued downward trend in the trading instrument. Pressure on the pound in the first half of the day could be formed by statements of British Foreign Secretary Boris Johnson. During the interview, Johnson expressed his dissatisfaction with the plan of the customs agreement, which was proposed by Prime Minister Theresa May and which should enter into force after Brexit.

According to the minister, the variant of the customs agreement contradicts everything that the UK aspired to by agreeing to Brexit and leaving the EU, since the preservation of import duties in favor of the EU will retain control over trade policy and laws.

Analysis are provided by InstaForex

Despite good industrial production figures in Germany for March of this year, the European currency continued its decline against the US dollar and a number of other world currencies on Tuesday morning. The speech of the chairman of the Fed was taken by traders with a certain optimism. Although, Powell did not touch on the conditions of monetary policy but instead spoke more about its impact on other developed economies of the world.

According to the report of the Federal Bureau of Statistics of Germany, industrial production in March 2018 grew by 1.0% compared with February, while economists expected an increase of 0.8%. As stated in the report, the main reason for the growth was the increase in production of capital goods. Compared with March 2017, industrial production in Germany increased by 3.2%.

Good data from Germany, after the disastrous beginning of the year, instilled some optimism in investors, but, as we see on the EURUSD chart, this is not enough.

The morning speech by the Chairman of the Federal Reserve, Jerome Powell, had a positive effect on the quotes of the US dollar. Powell said that despite the Fed's repeated increase in rates since December 2015, financial conditions in the US have become less stringent, while monetary stimulus has had only a relatively limited impact on the flow of capital in emerging economies in recent years. He also noted that the Fed, as much as possible, clearly intends to talk about the prospects of politics in order to avoid unrest in the markets.

As for the technical picture of the EURUSD pair, the downtrend persists and so far there are no prerequisites for a reversal. The breakdown at the support level of 1.1890 opens up new prospects for updating the lows in the areas of 1.1830 and 1.1790. The main goal now will be the level of the minimum of December 12, 2017 which is the level of 1.1717.

The British pound grew reluctantly but returned to the lower boundary of the side channel, which also indicates the continued downward trend in the trading instrument. Pressure on the pound in the first half of the day could be formed by statements of British Foreign Secretary Boris Johnson. During the interview, Johnson expressed his dissatisfaction with the plan of the customs agreement, which was proposed by Prime Minister Theresa May and which should enter into force after Brexit.

According to the minister, the variant of the customs agreement contradicts everything that the UK aspired to by agreeing to Brexit and leaving the EU, since the preservation of import duties in favor of the EU will retain control over trade policy and laws.

Analysis are provided by InstaForex

IFX Yvonne

Member

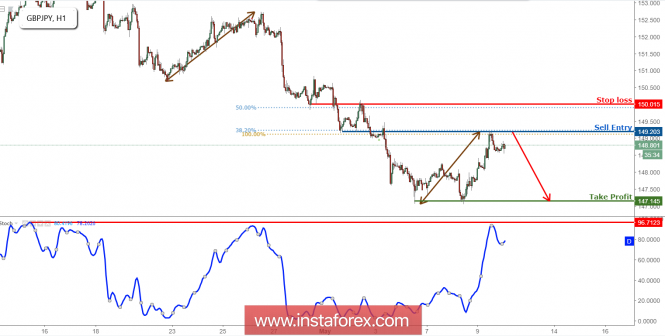

GBP/JPY Reversed Nicely Off Resistance, Remain Bearish

GBP/JPY reversed off its resistance at 149.20 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap resistance) where we expect prices to drop to its support at 147.14 (horizontal swing low support)

Stochastic (89, 5, 3) is reversed off its resistance at 96% where it has a lot of corresponding downside potential.

Sell 149.20. Stop loss at 150.01. Take profit at 147.14.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/JPY reversed off its resistance at 149.20 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap resistance) where we expect prices to drop to its support at 147.14 (horizontal swing low support)

Stochastic (89, 5, 3) is reversed off its resistance at 96% where it has a lot of corresponding downside potential.

Sell 149.20. Stop loss at 150.01. Take profit at 147.14.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaForex Gertrude

Active member

Euro buyers have a chance

Weak data on producer prices in the US and the performance of representatives of the Fed did not put much pressure on the US dollar, which will continue its steady growth against risky assets.

According to the report, the producer price index in the US for the month of April this year grew by only 0.1% after rising by 0.3% in March. Economists expected inflation to grow by 0.2%.

Compared to the same period in 2017, producer prices rose only 2.6%, also showing a slowdown. Economists had expected growth of 2.8%.

The speech of the President of the Federal Reserve Bank of Atlanta, Raphael Bostic, was rather optimistic.

Bostic said that a gradual increase in rates would lead to an increase in inflation above the target level and the economy is close or has already reached full employment.

He also noted that the Fed will continue to closely monitor the signs of rising price pressure, as inflation is close to achieving the target level.

According to the representative of the Fed, the main risk for the US economy is associated with uncertain prospects for trade.

The buyers of the euro managed to hold within the minimum of the month in yesterday's session, which indicates an upcoming upward correction. However, for this it is necessary to break above the resistance level of 1.1890, where the areas of 1.1930 and 1.1970 open.

The New Zealand dollar collapsed against the US dollar after the Reserve Bank of New Zealand left the official interest rate unchanged at 1.75%, saying that monetary policy will remain stimulating for a long time.

According to the RBNZ, the growth of the world economy will support the demand for New Zealand exports, and government and consumer spending will support GDP growth. Economists predict annual inflation of 2% in the fourth quarter of 2020, while the current level was previously expected in the third quarter. The official interest rate is also expected at 2% in the first quarter of 2020.

Data on the Chinese economy have passed without a trace for commodity currencies. According to the report, China's consumer price index rose by 1.8% in April compared to the same period last year. It is important to note that in March, the growth was 2.1%.

As noted in the report, the main pressure on the index was created by falling prices for pork. Compared with April 2017, it decreased by 16.1%. Prices for non-food products rose by 2.1%. Economists predicted that in April, consumer prices will rise by 1.9%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Weak data on producer prices in the US and the performance of representatives of the Fed did not put much pressure on the US dollar, which will continue its steady growth against risky assets.

According to the report, the producer price index in the US for the month of April this year grew by only 0.1% after rising by 0.3% in March. Economists expected inflation to grow by 0.2%.

Compared to the same period in 2017, producer prices rose only 2.6%, also showing a slowdown. Economists had expected growth of 2.8%.

The speech of the President of the Federal Reserve Bank of Atlanta, Raphael Bostic, was rather optimistic.

Bostic said that a gradual increase in rates would lead to an increase in inflation above the target level and the economy is close or has already reached full employment.

He also noted that the Fed will continue to closely monitor the signs of rising price pressure, as inflation is close to achieving the target level.

According to the representative of the Fed, the main risk for the US economy is associated with uncertain prospects for trade.

The buyers of the euro managed to hold within the minimum of the month in yesterday's session, which indicates an upcoming upward correction. However, for this it is necessary to break above the resistance level of 1.1890, where the areas of 1.1930 and 1.1970 open.

The New Zealand dollar collapsed against the US dollar after the Reserve Bank of New Zealand left the official interest rate unchanged at 1.75%, saying that monetary policy will remain stimulating for a long time.

According to the RBNZ, the growth of the world economy will support the demand for New Zealand exports, and government and consumer spending will support GDP growth. Economists predict annual inflation of 2% in the fourth quarter of 2020, while the current level was previously expected in the third quarter. The official interest rate is also expected at 2% in the first quarter of 2020.

Data on the Chinese economy have passed without a trace for commodity currencies. According to the report, China's consumer price index rose by 1.8% in April compared to the same period last year. It is important to note that in March, the growth was 2.1%.

As noted in the report, the main pressure on the index was created by falling prices for pork. Compared with April 2017, it decreased by 16.1%. Prices for non-food products rose by 2.1%. Economists predicted that in April, consumer prices will rise by 1.9%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Technical analysis of Gold for May 21, 2018

Gold price is breaking down below the recent $1,285-$1,295 consolidation. Gold price could see $1,270-75, but the bearish divergence signs continue to warn us that the next big move will be to the upside. I'm a buyer of Gold at the current or lower levels.

Blue lines - bullish divergence warning

Green lines - target levels

Yellow line - medium-term resistance

Red line - short-term resistance

Short-term resistance is at $1,292. I expect Gold price to soon break above it and move towards our first targets of $1,302-$1,304. Next important resistance is at $1,310-13 where I can see the next big trend test. With a break above this level, the price will move towards the 50% and 61.8% Fibonacci retracement. A weekly close above the 61.8% Fibonacci retracement will open the way for a bigger move towards $1,425. Gold is at its final stages of the move from the $1,365 level.

Analysis are provided by InstaForex

Gold price is breaking down below the recent $1,285-$1,295 consolidation. Gold price could see $1,270-75, but the bearish divergence signs continue to warn us that the next big move will be to the upside. I'm a buyer of Gold at the current or lower levels.

Blue lines - bullish divergence warning

Green lines - target levels

Yellow line - medium-term resistance

Red line - short-term resistance

Short-term resistance is at $1,292. I expect Gold price to soon break above it and move towards our first targets of $1,302-$1,304. Next important resistance is at $1,310-13 where I can see the next big trend test. With a break above this level, the price will move towards the 50% and 61.8% Fibonacci retracement. A weekly close above the 61.8% Fibonacci retracement will open the way for a bigger move towards $1,425. Gold is at its final stages of the move from the $1,365 level.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Pound returns to politics

Quotes of the GBP/USD slumped to a five-month low as it came under fire on three sides. The lack of a unified position within the conservative party on the basic principles of Brexit has revived political risks, negative statistics on the U.K. continues to reduce the likelihood of tightening the monetary policy of the Bank of England in 2018, and, finally, the unrestrained growth of the yield of Treasury bonds pushes up the US dollar. Such an unfavorable background makes the position of the sterling extremely vulnerable, but Forex is good because the situation can be turned upside down in a matter of moments.

Unexpected comments by Theresa May that Britain will still come out of the Customs Union, became a verdict for the pound. A week ago, the market was walking directly opposite rumors, which at that time had some support for the "bulls" on the GBP/USD. Even for a little while. The Prime Minister said that there is no reason for a second referendum on Scotland's independence, although in the North of the United Kingdom there are quite different sentiments. In general, the divide is felt in all politics, not only in the conservative party, which plays against sterling.

The futures market is on the verge of abandoning the idea of raising the REPO rate by 25 bp in 2018. Previously, there was confidence in two acts of monetary tightening, and after the May meeting of the Bank of England, the likelihood of a hike in August were regarded as a fifty-fifty. However, the busy economic calendar for the week to May 25 a priori nominates the pound for the title of the most interesting currency of the five-day period. Bloomberg analysts expect to see April inflation and GDP for the first quarter at the same levels of +2.5% yoy and +0.1% q/q, and also forecast a slowdown in retail sales to a six-month low. At the same time, the BoE in its most recent accompanying documents noted that the second assessment of January-March, in fact, is likely to be the best. If inflation also begins to move away from the target in the direction of 3%, the idea of two acts of monetary tightening in 2018 will rise from the ashes. And if so, then the "bulls" on the GBP/USD after long ordeals will still feel the ground beneath their feet.

Dynamics of the British inflation

The reason for their optimism can be slowed down and finally, the US dollar. Despite the fact that the news of a truce in the trade war between Beijing and Washington in the form of a temporary cancellation of tariffs for $150 billion imports has benefited the yield of Treasury bonds, however, Bloomberg's median forecast of 3.19% at the end of the year is already close, and the stabilization of the indicator will somewhat curb the enthusiasm of bulls in the USD index. In addition, after a continuous 4-week rally, some of them will probably want to lock in the profit.

Technically, a clear implementation of the "Broadening Wedge" pattern brought the pair's quotes beyond the upward trading channel, and the "bears" - to the operational space, and brought them closer to the target by 88.6% in the "Double Top" pattern at arm's length. It corresponds to the level of 1.32.

GBP/USD daily chart

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Quotes of the GBP/USD slumped to a five-month low as it came under fire on three sides. The lack of a unified position within the conservative party on the basic principles of Brexit has revived political risks, negative statistics on the U.K. continues to reduce the likelihood of tightening the monetary policy of the Bank of England in 2018, and, finally, the unrestrained growth of the yield of Treasury bonds pushes up the US dollar. Such an unfavorable background makes the position of the sterling extremely vulnerable, but Forex is good because the situation can be turned upside down in a matter of moments.

Unexpected comments by Theresa May that Britain will still come out of the Customs Union, became a verdict for the pound. A week ago, the market was walking directly opposite rumors, which at that time had some support for the "bulls" on the GBP/USD. Even for a little while. The Prime Minister said that there is no reason for a second referendum on Scotland's independence, although in the North of the United Kingdom there are quite different sentiments. In general, the divide is felt in all politics, not only in the conservative party, which plays against sterling.

The futures market is on the verge of abandoning the idea of raising the REPO rate by 25 bp in 2018. Previously, there was confidence in two acts of monetary tightening, and after the May meeting of the Bank of England, the likelihood of a hike in August were regarded as a fifty-fifty. However, the busy economic calendar for the week to May 25 a priori nominates the pound for the title of the most interesting currency of the five-day period. Bloomberg analysts expect to see April inflation and GDP for the first quarter at the same levels of +2.5% yoy and +0.1% q/q, and also forecast a slowdown in retail sales to a six-month low. At the same time, the BoE in its most recent accompanying documents noted that the second assessment of January-March, in fact, is likely to be the best. If inflation also begins to move away from the target in the direction of 3%, the idea of two acts of monetary tightening in 2018 will rise from the ashes. And if so, then the "bulls" on the GBP/USD after long ordeals will still feel the ground beneath their feet.

Dynamics of the British inflation

The reason for their optimism can be slowed down and finally, the US dollar. Despite the fact that the news of a truce in the trade war between Beijing and Washington in the form of a temporary cancellation of tariffs for $150 billion imports has benefited the yield of Treasury bonds, however, Bloomberg's median forecast of 3.19% at the end of the year is already close, and the stabilization of the indicator will somewhat curb the enthusiasm of bulls in the USD index. In addition, after a continuous 4-week rally, some of them will probably want to lock in the profit.

Technically, a clear implementation of the "Broadening Wedge" pattern brought the pair's quotes beyond the upward trading channel, and the "bears" - to the operational space, and brought them closer to the target by 88.6% in the "Double Top" pattern at arm's length. It corresponds to the level of 1.32.

GBP/USD daily chart

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Elliott wave analysis of EUR/NZD for May 25, 2018

EUR/NZD is now in its final stages of the wave c/ of ii/. Ideally, we will see a minor dip closer to support near 1.6806 before the wave ii/ is complete, but we would not be surprised to see a premature low form for a new rally higher through minor resistance at 1.6958 and, more importantly, above resistance at 1.7061 confirming that the wave iii/ higher to test important resistance at 1.7300 is developing.

R3: 1.7061

R2: 1.6981

R1: 1.6958

Pivot: 1.6915

S1: 1.6883

S2: 1.6846

R3: 1.6806

Trading recommendation: We are looking for a EUR-buying opportunity at 1.6815 or upon a break above 1.6960.

Analysis are provided by InstaForex

EUR/NZD is now in its final stages of the wave c/ of ii/. Ideally, we will see a minor dip closer to support near 1.6806 before the wave ii/ is complete, but we would not be surprised to see a premature low form for a new rally higher through minor resistance at 1.6958 and, more importantly, above resistance at 1.7061 confirming that the wave iii/ higher to test important resistance at 1.7300 is developing.

R3: 1.7061

R2: 1.6981

R1: 1.6958

Pivot: 1.6915

S1: 1.6883

S2: 1.6846

R3: 1.6806

Trading recommendation: We are looking for a EUR-buying opportunity at 1.6815 or upon a break above 1.6960.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Trading Plan for EUR/USD for May 28, 2018

Technical outlook:

The EUR/USD pair finally looks to stage a counter trend rally towards the 1.1950/1.2050 levels from here. In the immediate short term outlook, the pair should be looking to take out the 1.1750 levels, which is short term resistance. Then expect a dip towards the 1.1670/80 levels, before the counter trend rally gains further momentum higher. Please note that the 0.382 fibonacci resistance is seen at the 1.1940/50 levels as projected here. Immediate price support is seen at the 1.1500 levels, which should be the next potential target for bears. Now looking into the wave counts, the EUR/USD pair is still progressing into its 3rd wave of a lesser degree and is expected to carve the wave 4, before dropping lower into the wave 5 within the wave (3) as depicted here. Selling on rallies remains a preferred trading strategy for now.

Trading plan:

Aggressive traders may initiate longs around the 1.1675/1.1700 levels going forward; while conservative traders may remain flat for now and look forward to sell again between the 1.1930 and 1.2050 levels respectively.

Fundamental outlook:

There are no major events lined up for the day.

Good luck!

Analysis are provided by InstaForex

Technical outlook:

The EUR/USD pair finally looks to stage a counter trend rally towards the 1.1950/1.2050 levels from here. In the immediate short term outlook, the pair should be looking to take out the 1.1750 levels, which is short term resistance. Then expect a dip towards the 1.1670/80 levels, before the counter trend rally gains further momentum higher. Please note that the 0.382 fibonacci resistance is seen at the 1.1940/50 levels as projected here. Immediate price support is seen at the 1.1500 levels, which should be the next potential target for bears. Now looking into the wave counts, the EUR/USD pair is still progressing into its 3rd wave of a lesser degree and is expected to carve the wave 4, before dropping lower into the wave 5 within the wave (3) as depicted here. Selling on rallies remains a preferred trading strategy for now.

Trading plan:

Aggressive traders may initiate longs around the 1.1675/1.1700 levels going forward; while conservative traders may remain flat for now and look forward to sell again between the 1.1930 and 1.2050 levels respectively.

Fundamental outlook:

There are no major events lined up for the day.

Good luck!

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Elliott wave analysis of EUR/NZD for May 30, 2018

The break below the important support at 1.6670 was unexpected and has forced us to shift our long-term count. This new count still favors a bullish outlook, but sees a very complex corrective structure in the wave ii. From the peak of the wave i at 1.7099 in early February, a double corrective combination has been seen. First, a flat correction as the wave W and then a expanded flat as the wave Y to complete the wave ii. Either the wave ii is complete or very close to completing near after a final spike to just below 1.6653.

In the short-term, a break above the minor resistance at 1.6786 and, more importantly, a break above 1.6903 will confirm that the wave ii has completed and a new impulsive rally in the wave iii is developing above 1.7300.

R3: 1.6903

R2: 1.6828

R1: 1.6786

Pivot: 1.6710

S1: 1.6653

S2: 1.6642

S3: 1.6607

Trading recommendation:

Our stop at 1.6665 was triggered for a loss of 150 pips. We will be looking for a new buying opportunity, but waiting for a break above 1.6786.

Analysis are provided by InstaForex

The break below the important support at 1.6670 was unexpected and has forced us to shift our long-term count. This new count still favors a bullish outlook, but sees a very complex corrective structure in the wave ii. From the peak of the wave i at 1.7099 in early February, a double corrective combination has been seen. First, a flat correction as the wave W and then a expanded flat as the wave Y to complete the wave ii. Either the wave ii is complete or very close to completing near after a final spike to just below 1.6653.

In the short-term, a break above the minor resistance at 1.6786 and, more importantly, a break above 1.6903 will confirm that the wave ii has completed and a new impulsive rally in the wave iii is developing above 1.7300.

R3: 1.6903

R2: 1.6828

R1: 1.6786

Pivot: 1.6710

S1: 1.6653

S2: 1.6642

S3: 1.6607

Trading recommendation:

Our stop at 1.6665 was triggered for a loss of 150 pips. We will be looking for a new buying opportunity, but waiting for a break above 1.6786.

Analysis are provided by InstaForex

InstaForex Gertrude

Active member

Elliott wave analysis of EUR/NZD for May 31, 2018

Wave ii/ likely saw a low with the test of 1.6624. We still need to see a break above the resistance-line near 1.6734 and more importantly a break above minor resistance at 1.6764 to add confidence in our view that a low likely is in place. As long as minor resistance at 1.6764 is able to cap the upside, we could still see another attack towards the downside, but the downside potential seems very limited from here.

A break above minor resistance at 1.6764 will target the more important resistance at 1.7062 and above here will confirm that wave iii/ to above 1.7300 is developing.

R3: 1.6903

R2: 1.6829

R1: 1.6764

Pivot: 1.6705

S1: 1.6683

S2: 1.6656

S3: 1.6624

Trading recommendation:

We will buy a break above minor resistance at 1.6764 and if done place our stop at 1.6620.

Analysis are provided by InstaForex

Wave ii/ likely saw a low with the test of 1.6624. We still need to see a break above the resistance-line near 1.6734 and more importantly a break above minor resistance at 1.6764 to add confidence in our view that a low likely is in place. As long as minor resistance at 1.6764 is able to cap the upside, we could still see another attack towards the downside, but the downside potential seems very limited from here.

A break above minor resistance at 1.6764 will target the more important resistance at 1.7062 and above here will confirm that wave iii/ to above 1.7300 is developing.

R3: 1.6903

R2: 1.6829

R1: 1.6764

Pivot: 1.6705

S1: 1.6683

S2: 1.6656

S3: 1.6624

Trading recommendation:

We will buy a break above minor resistance at 1.6764 and if done place our stop at 1.6620.

Analysis are provided by InstaForex

IFX Yvonne

Member

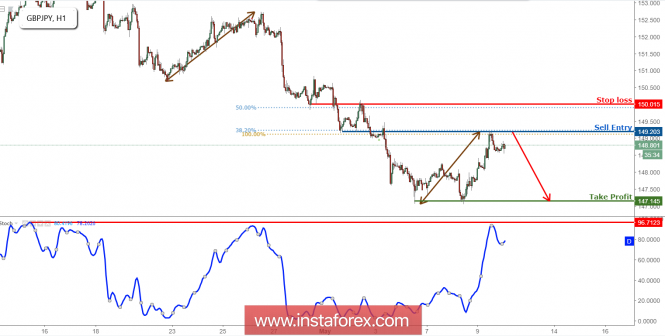

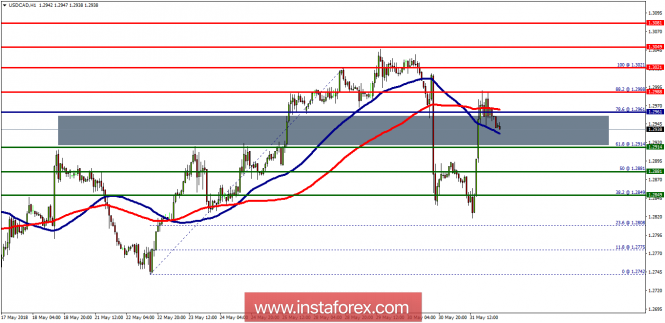

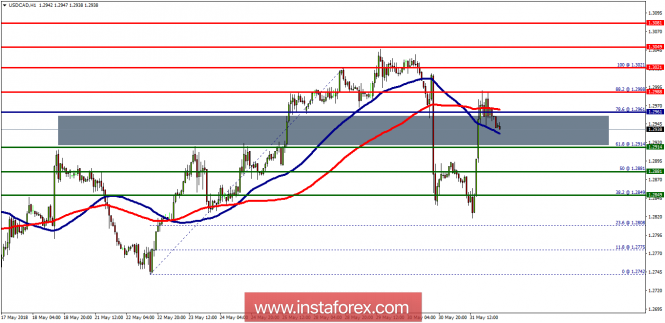

Technical analysis of USD/CAD for June 01, 2018

Overview:

Pivot: 1.2961.

The USD/CAD pair will continue to rise from the level of 1.2914. The support is found at the level of 1.2914, which represents the 61.8% Fibonacci retracement level on the H1 chart. The price is likely to form a double bottom. Today, the major support is seen at 1.2914, while immediate resistance is seen at 1.3021. Accordingly, the USD/CAD pair is showing signs of strength following a breakout of the high at 1.2914. So, buy above the level of 1.2914 with the first target at 1.3021 in order to test the daily resistance 1 and move further to 1.3049. Also, the level of 1.3049 is a good place to take profit because it will form a new double top. Amid the previous events, the pair is still in an uptrend; for that we expect the USD/CAD pair to climb from 1.2914 to 1.3049 today. At the same time, in case a reversal takes place and the USD/CAD pair breaks through the support level of 1.2914, a further decline to 1.2849 can occur, which would indicate a bearish market.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Overview:

Pivot: 1.2961.

The USD/CAD pair will continue to rise from the level of 1.2914. The support is found at the level of 1.2914, which represents the 61.8% Fibonacci retracement level on the H1 chart. The price is likely to form a double bottom. Today, the major support is seen at 1.2914, while immediate resistance is seen at 1.3021. Accordingly, the USD/CAD pair is showing signs of strength following a breakout of the high at 1.2914. So, buy above the level of 1.2914 with the first target at 1.3021 in order to test the daily resistance 1 and move further to 1.3049. Also, the level of 1.3049 is a good place to take profit because it will form a new double top. Amid the previous events, the pair is still in an uptrend; for that we expect the USD/CAD pair to climb from 1.2914 to 1.3049 today. At the same time, in case a reversal takes place and the USD/CAD pair breaks through the support level of 1.2914, a further decline to 1.2849 can occur, which would indicate a bearish market.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

IFX Yvonne

Member

Technical analysis of Bitcoin for June 04, 2018

If we look at the 4-hour chart, we see that Bitcoin has hit the dynamic support Exponential 100-period Moving Average by Close (near a downward sloping channel). It seems that BTC is going down to test the lower channel and this has been already confirmed too by divergence between the Stochastic Oscillator and the price. A long as this Cryptocurrency does not break out and closes above the 7,754.45 level, the bias of the Bitcoin price is still bearish.

(Disclaimer)

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If we look at the 4-hour chart, we see that Bitcoin has hit the dynamic support Exponential 100-period Moving Average by Close (near a downward sloping channel). It seems that BTC is going down to test the lower channel and this has been already confirmed too by divergence between the Stochastic Oscillator and the price. A long as this Cryptocurrency does not break out and closes above the 7,754.45 level, the bias of the Bitcoin price is still bearish.

(Disclaimer)

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.