InstaForex Gertrude

Active member

The trade war holds the

The Australian dollar was marked by an impressive spurt due to an increase in global appetite for risk after the release of data on the US labor market, the release of strong statistics on retail sales and optimistic forecasts of the OECD. The authoritative organization believes that the Reserve Bank of Australia will begin to raise the main interest rate at the end of 2018 against the background of acceleration of average wages and inflation. GDP will grow by 2.9% this year and by 3% next year, unemployment will decrease to 5.4% in 2018 and to 5.3% in 2019. OECD believes that the main reasons for strong economic growth in Australia will be favorable the conjuncture of the commodity market and strong external demand.

The optimism of the Organization of Economic Cooperation and Development is not shared by the futures market, which, on the contrary, has shifted the expectations of the first increase in the cash rate since 2016 from the current 1.5% to the second half of 2019. Along with unfavorable internal factors in the form of sluggish labor and inflation, leaving much to be desired (unlike the main developed countries, unemployment in Australia is far from full employment (5%), investors are apprehensive about the trade wars, the rise in the cost of borrowing in the United States and the Italian political crisis. The shift in the timing of the start of the normalization of the monetary policy of RBA, along with the worsening global appetite for risk, put pressure on the Australian dollar.

Dynamics of MSCI EM and the probability of increasing the cash rate

One of the main problems of the "Aussie" is connected with the growth of the yield of US treasury bonds against the background of expectations of raising the Federal Reserve rate on federal funds to 2.5% within 12 months. This circumstance, coupled with the unwillingness of the RBA to change anything in the field of monetary policy, allows Morgan Stanley to recommend its clients to sell the AUD/USD. The yield differential between the 10-year Australian and American bonds is -15 bp, with an average value of the indicator for the last five years at +68 bpts. Such a situation on the debt market deprives the "Aussie" of support from carry traders who prefer to invest in assets of developing countries.

Additional pressure on the "Aussie" poses the risks of a trade war. The US is going to pause it, then revive the idea of import duties on steel and aluminum due to the intractability of its trading partners from Canada, Mexico and the EU, they openly shout about military actions. Donald Trump on his Twitter account said if you one $800 billion annually, there is no point in fearing a trade war. Under US pressure, China could reduce purchases of goods and services from Australia, which will negatively affect its economy. However, short-term strong statistics on retail sales, GDP and moderate optimism of the RBA may contribute to the correction of AUD/USD.

Technically, the return of the pair's quotations to the boundaries of the long-term upward trading channel will increase the risks of implementing the Bat pattern with a target of 88.6%.

AUD/USD, daily chart

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

The Australian dollar was marked by an impressive spurt due to an increase in global appetite for risk after the release of data on the US labor market, the release of strong statistics on retail sales and optimistic forecasts of the OECD. The authoritative organization believes that the Reserve Bank of Australia will begin to raise the main interest rate at the end of 2018 against the background of acceleration of average wages and inflation. GDP will grow by 2.9% this year and by 3% next year, unemployment will decrease to 5.4% in 2018 and to 5.3% in 2019. OECD believes that the main reasons for strong economic growth in Australia will be favorable the conjuncture of the commodity market and strong external demand.

The optimism of the Organization of Economic Cooperation and Development is not shared by the futures market, which, on the contrary, has shifted the expectations of the first increase in the cash rate since 2016 from the current 1.5% to the second half of 2019. Along with unfavorable internal factors in the form of sluggish labor and inflation, leaving much to be desired (unlike the main developed countries, unemployment in Australia is far from full employment (5%), investors are apprehensive about the trade wars, the rise in the cost of borrowing in the United States and the Italian political crisis. The shift in the timing of the start of the normalization of the monetary policy of RBA, along with the worsening global appetite for risk, put pressure on the Australian dollar.

Dynamics of MSCI EM and the probability of increasing the cash rate

One of the main problems of the "Aussie" is connected with the growth of the yield of US treasury bonds against the background of expectations of raising the Federal Reserve rate on federal funds to 2.5% within 12 months. This circumstance, coupled with the unwillingness of the RBA to change anything in the field of monetary policy, allows Morgan Stanley to recommend its clients to sell the AUD/USD. The yield differential between the 10-year Australian and American bonds is -15 bp, with an average value of the indicator for the last five years at +68 bpts. Such a situation on the debt market deprives the "Aussie" of support from carry traders who prefer to invest in assets of developing countries.

Additional pressure on the "Aussie" poses the risks of a trade war. The US is going to pause it, then revive the idea of import duties on steel and aluminum due to the intractability of its trading partners from Canada, Mexico and the EU, they openly shout about military actions. Donald Trump on his Twitter account said if you one $800 billion annually, there is no point in fearing a trade war. Under US pressure, China could reduce purchases of goods and services from Australia, which will negatively affect its economy. However, short-term strong statistics on retail sales, GDP and moderate optimism of the RBA may contribute to the correction of AUD/USD.

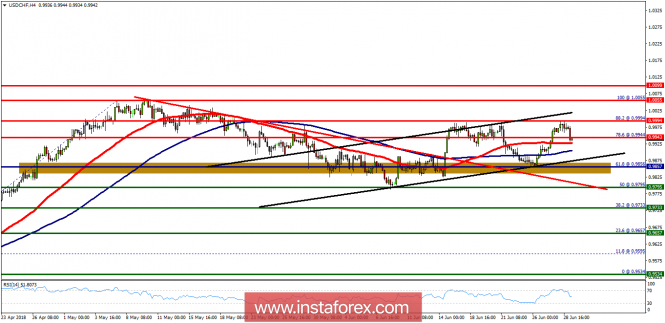

Technically, the return of the pair's quotations to the boundaries of the long-term upward trading channel will increase the risks of implementing the Bat pattern with a target of 88.6%.

AUD/USD, daily chart

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex