IFX Yvonne

Member

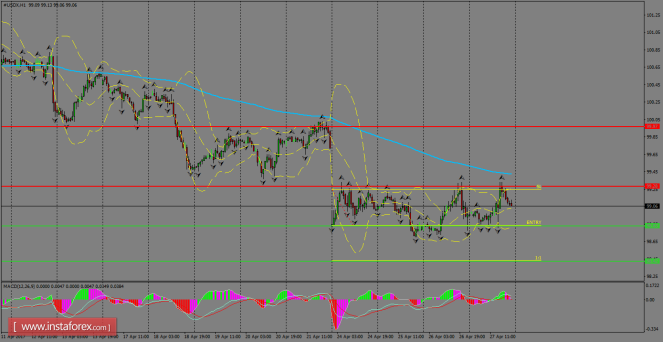

USD/CAD intraday technical levels and trading recommendations for April 18, 2017

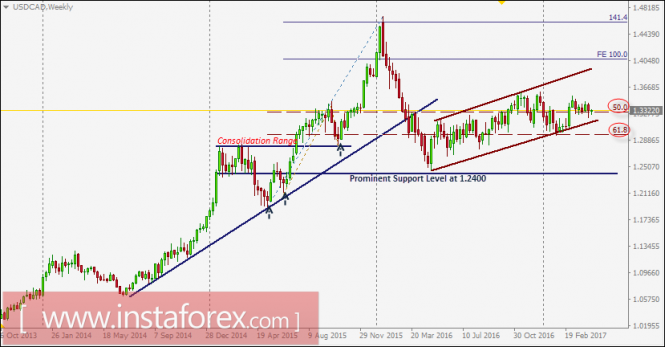

Since April 2016, the USD/CAD pair has been trending upward within the depicted ascending channel.

In December 2016, a bullish breakout above 1.3300 (50% Fibonacci level) was expected to allow a further advance toward 1.3700-1.3750 (the upper limit of the depicted channel).

However, significant bearish rejection was expressed around 1.3580 (recently established top).

During the bearish pullback, the price level of 1.3300 (50% Fibonacci Level) failed to provide enough support to the pair.

This allowed a further bearish movement toward the price level of 1.2970 (61.8% Fibonacci level) where a valid BUY entry was offered in February 2017.

Three weeks ago, the bullish breakout above 1.3300 (50% Fibonacci Level) enhanced a further advance toward 1.3440 and 1.3530.

The next bullish target would be located around 1.3800 (upper limit of the depicted channel) if the pair maintains upside trading above 1.3300 (50% Fibonacci Level) which stands as a prominent support level.

On the other hand, if the USD/CAD pair moves below 1.3300, it may become trapped again within the depicted consolidation range (1.3300-1.2970).

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

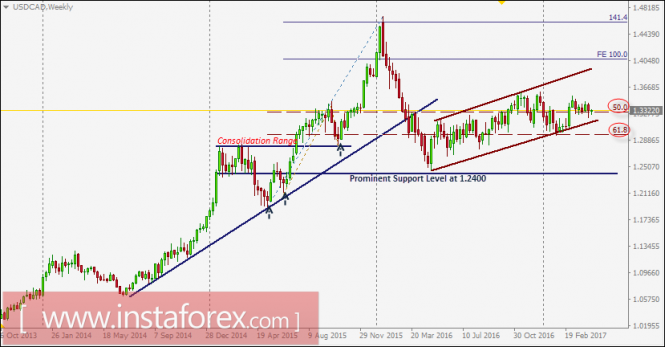

Since April 2016, the USD/CAD pair has been trending upward within the depicted ascending channel.

In December 2016, a bullish breakout above 1.3300 (50% Fibonacci level) was expected to allow a further advance toward 1.3700-1.3750 (the upper limit of the depicted channel).

However, significant bearish rejection was expressed around 1.3580 (recently established top).

During the bearish pullback, the price level of 1.3300 (50% Fibonacci Level) failed to provide enough support to the pair.

This allowed a further bearish movement toward the price level of 1.2970 (61.8% Fibonacci level) where a valid BUY entry was offered in February 2017.

Three weeks ago, the bullish breakout above 1.3300 (50% Fibonacci Level) enhanced a further advance toward 1.3440 and 1.3530.

The next bullish target would be located around 1.3800 (upper limit of the depicted channel) if the pair maintains upside trading above 1.3300 (50% Fibonacci Level) which stands as a prominent support level.

On the other hand, if the USD/CAD pair moves below 1.3300, it may become trapped again within the depicted consolidation range (1.3300-1.2970).

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com