InstaForex Gertrude

Active member

Forex Analysis & Reviews: Forecast for USD/JPY on January 20, 2023

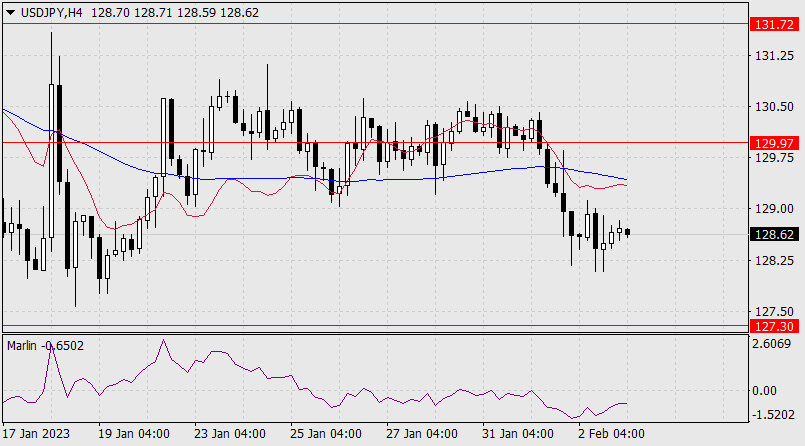

After the yen experienced increased volatility on Wednesday, the currency in question is moving sideways both yesterday and this morning as well. At the same time, traders are still bullish on the pair, the nearest target is 129.80, which is the line of the price channel on the higher chart. In case the quote continues to rise, the upper line of the descending green price channel is waiting around the 130.67 mark. Leaving the channel will open the next target at 133.60.

The Marlin oscillator supports the price growth by rising in its own ascending channel. Crossing the signal line of the oscillator above the zero line will strengthen the price growth. On the four-hour chart, the Marlin oscillator is rising in the green zone, but growth is hampered by resistance of the balance indicator line. The MACD line is currently above the price, above the resistance of 129.80 on the daily chart.

Also, considering the downtrend, we can assume other market obstacles to the pair's growth. With time, however, we still expect a full-fledged correction from the price decline from October 21.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Read More https://ifxpr.com/3XHpiEr

After the yen experienced increased volatility on Wednesday, the currency in question is moving sideways both yesterday and this morning as well. At the same time, traders are still bullish on the pair, the nearest target is 129.80, which is the line of the price channel on the higher chart. In case the quote continues to rise, the upper line of the descending green price channel is waiting around the 130.67 mark. Leaving the channel will open the next target at 133.60.

The Marlin oscillator supports the price growth by rising in its own ascending channel. Crossing the signal line of the oscillator above the zero line will strengthen the price growth. On the four-hour chart, the Marlin oscillator is rising in the green zone, but growth is hampered by resistance of the balance indicator line. The MACD line is currently above the price, above the resistance of 129.80 on the daily chart.

Also, considering the downtrend, we can assume other market obstacles to the pair's growth. With time, however, we still expect a full-fledged correction from the price decline from October 21.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Read More https://ifxpr.com/3XHpiEr