InstaForex Gertrude

Active member

Forex Analysis & Reviews: Technical Analysis of Intraday Price Movements of Nasdaq 100 Index, Thursday December 29 2022

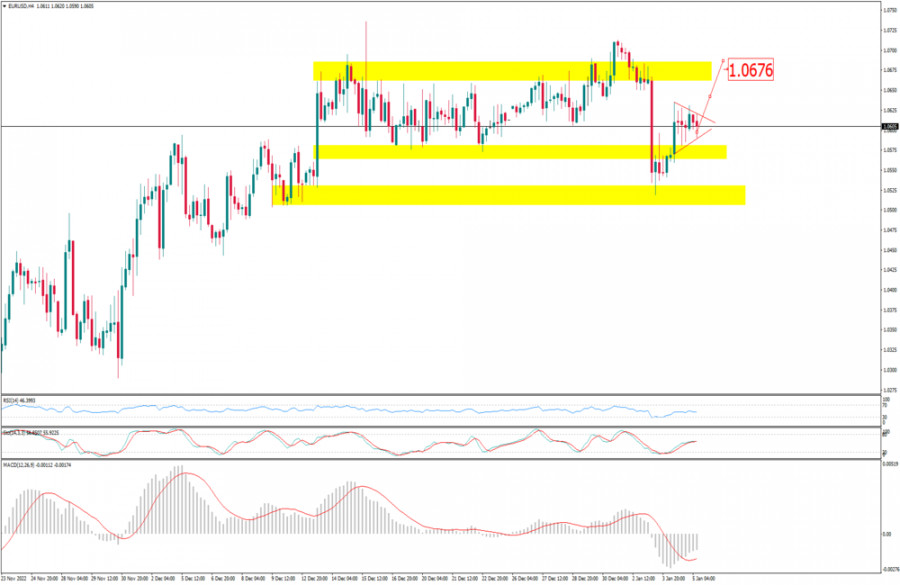

With the appearance of the deviation between Nasdaq 100 index price movements with the indicator as well as the price movement which is below the 100 Moving Average and the appearance of the Bearish 123 pattern which is followed by a break of Ross Hook (RH), it is certain that the #NDX condition is in a bearish situation which in the near future seems to be experiencing a slight upward correction to test the Vaccum Block area level the range 10993.7-11028.6 which happens to be also within the Bearish Fair Value Gap level area if the levels in this area function as resistance quite well and as long as the upward correction does not exceed above the 11233.6 level then #NDX will continue its decline back to the 10616.1 level as the first target and level 10433.8 as the second target.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Read More https://ifxpr.com/3PYV2Cc

With the appearance of the deviation between Nasdaq 100 index price movements with the indicator as well as the price movement which is below the 100 Moving Average and the appearance of the Bearish 123 pattern which is followed by a break of Ross Hook (RH), it is certain that the #NDX condition is in a bearish situation which in the near future seems to be experiencing a slight upward correction to test the Vaccum Block area level the range 10993.7-11028.6 which happens to be also within the Bearish Fair Value Gap level area if the levels in this area function as resistance quite well and as long as the upward correction does not exceed above the 11233.6 level then #NDX will continue its decline back to the 10616.1 level as the first target and level 10433.8 as the second target.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Read More https://ifxpr.com/3PYV2Cc