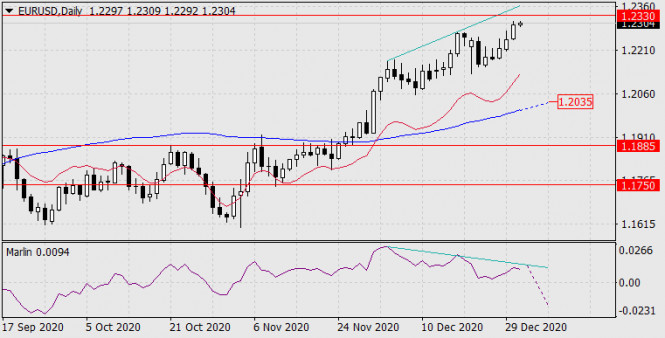

Forex Analysis & Reviews: Overview of the EUR/USD pair. January 22. The euro currency shows its readiness to return to 2.5-year highs.

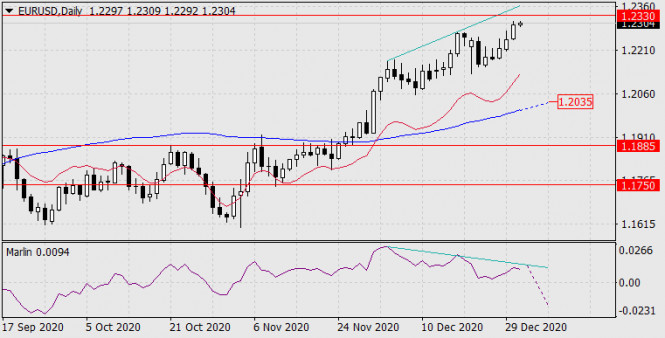

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 105.3571

The EUR/USD currency pair on Thursday, January 21, waited for half a day for the results of the meeting of the European Central Bank. And when they were announced, it turned out that there was not much to react to. But more on that below. From a technical point of view, the euro/dollar pair has consolidated above the moving average line, so the trend on the 4-hour timeframe has changed to an upward trend. So what can we expect now? How is the pound/dollar pair moving? According to the technique, everything now looks like this: there was a downward correction of almost 300 points within the upward trend. Therefore, now is the time to resume the upward trend. Of course, this is still only a hypothesis, but given the continuing weak demand for the US currency and the complete disregard for the fundamental background, this is the conclusion that suggests itself.

Let's go back to the ECB meeting and its results. Here, all the results can be described in one sentence: the regulator left the monetary policy parameters unchanged. None of the traders expected that the ECB at the first meeting in 2021 will change the rate or begin to further increase the quantitative easing program or its "emergency counterpart" - the PEPP program. Thus, the interest rate on loans remained at 0%, on deposits - at -0.5%, and the volume of the PEPP (Pandemic Emergency Purchase Program) – at 1.85 trillion euros. Perhaps there is nothing more to say here. The fact that traders reacted to this news with purchases of the euro currency has no connection at all with what is happening. Simply put, this was not the reaction of traders to the ECB meeting. Let's get this straight: 90% of the time, almost any instrument moves either up or down. That is, the upward movement on January 21 may be a simple coincidence. The markets were going to buy the euro currency without the ECB meeting, that's all. There was nothing to react to. The ECB has not made any changes to monetary policy.

Therefore, you can forget about the meeting and focus on the problems of the Eurozone. Because there are now much more of them than, for example, the American economy. The problem of high public debt in the United States is already something of a byword. This problem has been discussed by all experts, economists, and analysts for a couple of decades. However, along with this "unsolvable" problem, the American economy continues to grow and remains in first place in the world. Yes, some studies suggest that in 10 years or so, the Chinese economy may come out on top in the world in terms of size. However, this is still written with a pitchfork on the water. No one knows what will happen in 10 years. Could anyone have predicted the "coronavirus"? Yes, new viruses and diseases appear from time to time on the planet Earth, but who could have predicted that the whole world would be mired in a pandemic for a whole year? And it's not over yet. Thus, we would recommend paying attention to indicators that reflect the state of the economy here and now. The eurozone also has enough debt. They are not so huge, but they are. For example, only the eurozone recovery fund for 750 billion euros will be formed from borrowed funds, which will be returned for several decades. These are the same debts.

But we look at the GDP forecasts for the fourth quarter and see: -2.2% is forecasted in the Eurozone; +4.2% - +4.4% is forecasted in the United States. Thus, despite all the problems, despite the first place in the world in the number of cases of coronavirus, despite the first place in the world in the number of deaths from COVID, despite the lack of a package of assistance to the economy, the unemployed and businesses, it is the American economy that continues to recover after the second quarter of 2020, while the European economy will again shrink. Naturally, this is due to the second "lockdown", which was in the EU, but not in the United States. However, what difference does it make between the economies for such an imbalance in the fourth quarter? The fact remains.

But despite this, the European currency as a whole continues to grow. It is still very difficult to find any reasons for the strengthening of the euro and the fall of the US dollar. We have already talked about the economy. There are no serious geopolitical problems now either in the EU or in the United States. Moreover, it is the European Union that has recently lost part of its "own" territory (Great Britain). There is one less country in the European Union. And not just for one country, but for a country with an economy in the TOP 10 in the world. However, before and after Brexit, the European currency continued to grow. Political problems, crisis? Yes, it was in the States for almost all of 2020. In Europe, there were other problems, but they were successfully resolved. But the European currency can not grow for about 10 months just because of the political crisis in the United States.

Therefore, based on all of the above, we can conclude that the factors that push the euro up and the dollar down do not lie on the surface. First, it may be a speculative factor, which we have already discussed. First, the upward trend began, and it began quite rightly (four types of crises in the US in 2020, which even Joe Biden recently announced). And in recent months, traders buy the euro and get rid of the dollar. The second hypothetical reason may lie in the plane of large players. We have repeatedly said that small traders do not make any weather in the market. Markets are driven by big players. This, of course, is not one or two central banks. There are thousands of them, but still not millions. And their volumes are different. Thus, it is quite possible that in the highest circles they have completely different information that is not available to ordinary traders. Based on this information, transactions for the sale of the dollar can be made. The third possible reason is purely technical. If you look at the monthly timeframe, it becomes clear that the euro currency has been falling in price for 12 years. For a global trend, a period of 10-12 years is the ideal time to complete. Thus, now may be the time for a long-term upward trend in the euro (from 2000 to 2008, the euro rose in price), or it is time for a technical correction to the area of the level of 1.4000. Of course, confirmation of these assumptions will be extremely difficult to obtain. Therefore, as before, we recommend following the trend, and not trying to guess the reversal, especially long-term. It is better to settle for less profit than to lose everything.

The volatility of the euro/dollar currency pair as of January 22 is 70 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2083 and 1.2223. A downward reversal of the Heiken Ashi indicator may signal a new round of downward correction.

Nearest support levels:

S1 – 1.2085

S2 – 1.1963

S3 – 1.1841

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2329

R3 – 1.2451

Trading Recommendations:

The EUR/USD pair has consolidated above the moving average. Thus, today it is recommended to stay in long positions with targets of 1,2207 and 1,2223 until the Heiken Ashi indicator turns down. It is recommended to consider sell orders if the pair is fixed back below the moving average with a target of 1.2085.

Analysis are provided by InstaForex