Is gold going higher and higher and higher?

After many years of waiting, the hopes of investors who invest in gold were finally rewarded, as gold showed an impressive trend in the first half of 2019, which was caused by several reasons. Is it worth it to invest money in gold now and is it time to take profits to those who bought gold from the levels of $1,300, we will analyze in this article.

If we consider gold from the point of view of distant investment horizons, then investors should have no questions at all. Regardless of the behavior of gold in the derivatives market, it should be in the portfolio of each investor in a volume of up to 20% or more if the portfolio is denominated in reserve currencies. Even if gold falls short in price in the short term, it should be taken as the foundation of a house: you don't want to bury money in the ground, but you have to, because you need to build a house on stone and not on sand. Moreover, in the long run, gold is the most profitable asset in any currency.

Since 2001, gold has increased by five times in price against the dollar. The price of gold was $287 per troy ounce on September 11, 2001 but now gold is worth $1,415. Over the same period, investments in S&P 500 stocks, inflated from free money in the last ten years, have brought a yield of "just" 2.8 times the return - it was 1,050, it was 3,000. No one argues, 285% is good, but you have to agree that 500% is better, and if you take 2008-2009, then there were no questions at all as to where money should be invested - in gold or shares.

It seems to me that the best investment in order to save money for retirement or the education of children will be an investment in gold coins. Yes, there are periods of recession, but long-term gold is a very stable and profitable asset. Over a period of 20 years, gold gives an annual increase of 8% on invested capital.

Of course, it's easy to talk about a distance of two decades, it's more difficult to figure out shorter periods, but we'll try. If we talk about the current time, then, according to the World Gold Council, now the following factors influence the situation:

Financial market uncertainty and adaptive monetary policies are likely to support investment demand for gold; Price momentum and positioning can stimulate rallies and create kickbacks, as investors constantly revise their expectations based on new information; Weaker economic growth in the near term could soften consumer demand for gold, but structural economic reforms in India and China are likely to support long-term demand.

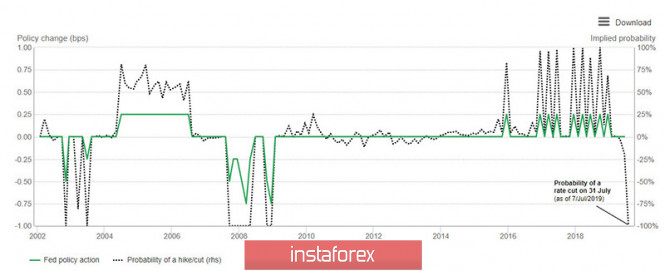

Regarding monetary policy easing, Federal Reserve Chairman Jerome Powell and the Open Market Committee now occupy a balanced policy and would rather prefer not to lower the rate at the next meeting, which will be held in late June. However, markets literally force the Fed to do this, suggesting a 100 percent likelihood of such a move. As the analysis conducted by the World Gold Council shows, the US Federal Open Market Committee conducted a rate change whenever more than 65% of traders expected such a move from it (Fig. 1).

Figure 1: Changes in the Fed's monetary policy in line with market expectations. Source: World Gold Council

Despite good inflation data (core inflation rose to 2.1% in June) and excellent unemployment data, the Fed is unlikely to decide to go against the will of the markets and leave the rate unchanged. In turn, the rate reduction is negative for the US dollar, which will lose 0.25% of potential, which is very likely to lead to a decrease in the dollar against a basket of major reserve currencies. At the same time, the US dollar has a 90 percent negative correlation with the US dollar. Earlier, in 2010 - 2015, gold significantly correlated with the yen, but later began to correlate with the euro and the dollar, in turn, the correlation with the yen had decreased.

Speaking about the factors that highly affect the price of gold, it is necessary to note the demand of exchange-traded funds - ETF - and the positioning of Money Manager speculators in the futures market. They are the main buyers of gold, and it is the influx of money to the derivatives market that determines the medium and short-term price dynamics. By volume, the COMEX-CME conglomerate is the largest exchange for trading gold and its derivatives, followed by London and Shanghai.

From June 1, Open Interest, which characterizes the influx of new money into the market, grew by more than a quarter and for the first time in history exceeded the level of 1 million contracts. However, in July, the process slowed down somewhat and has stabilized at this point. Some traders preferred to take profits, which resulted in a slight decrease in OI to 1.01 million. Speculators, after the explosive growth of May-June, also slightly reduced their long positions, which currently amount to 241 thousand contracts. At the same time, short positions of speculators remain at the lowest values of 24.3 thousand contracts (Fig. 2), which does not indicate their desire to sell gold against its trend. Therefore, wishing to open a short position in gold should not be smarter than the market. Traders need to be with the market, and if you call yourself a speculator, then you must act together with the Money Manager, and not against them.

Fig.2: Position of traders in the COT report. Source Commodity Futures Commission - CFTC

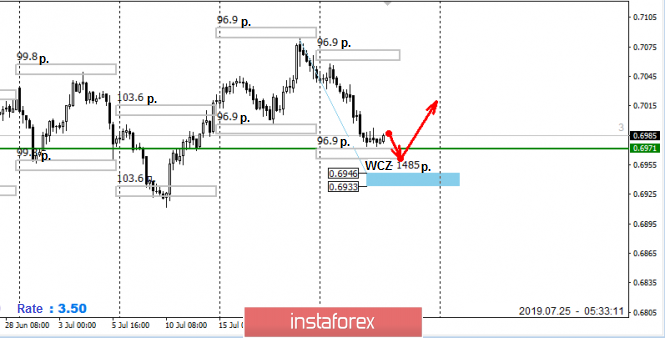

Based on the above factors, as well as technical analysis, it can be assumed that the range of 1380-1435, formed by the price of gold in the previous three weeks, is more likely a continuation figure than a reversal figure. In this case, in the event of growth, gold has every change to reach the level of $1500 and continue further upward movement.

However, if the Fed does not lower the rate, which is now highly unlikely, or Jerome Powell's comments on future monetary policy prospects will lead to an increase in the US dollar, there is some small chance that gold could fall to $1,375-$1,350. In this case, traders should remember that "Murphy's Law" says that if trouble can happen, it will happen, it will be realized on the markets with an enviable constancy. In this regard, no need to make exceptions to the rules of money management and open positions that you can not afford to lose.

Analysis are provided byInstaForex.