EUR/USD. Week Preview. Buckle up, price turbulence expected

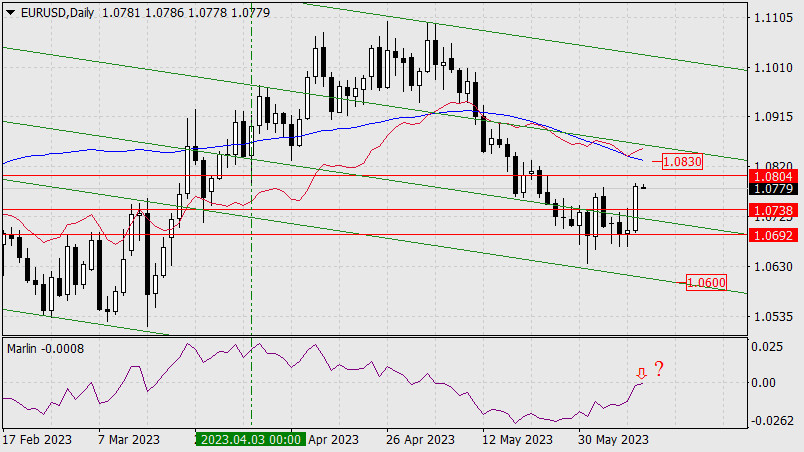

The EUR/USD pair failed to consolidate within the 7th figure by the end of the past week: at the end of Friday's trading, EUR/USD bulls organized a small but swift counter-attack, which led the price to rise to the level of 1.0804. The corrective pullback was due to a weakening of the US currency, which came under pressure against the backdrop of Jerome Powell's cautious rhetoric.

The Chairman of the Federal Reserve suggested that the May rate hike could be the last in the current monetary policy tightening cycle. This unexpected plot twist unpleasantly surprised dollar bulls, after which the greenback fell across the market. Under other circumstances, this fundamental factor would have had a strong impact on the dollar for a quite long time. But under current conditions, Powell's "dovish" comments may take a back seat. The focus is on the political confrontation between Republicans and Democrats, whose inability to reach an agreement could lead to a default on the US national debt.

There is no doubt that this topic will be the "number 1 issue" for all dollar pairs. All other fundamental factors will take a back seat - including Powell.

Biden raises the stakes

Exactly one week ago - May 14 - the President of the United States announced that negotiations with Congress on raising the debt ceiling are "progressing," and more about their progress will be known literally "in the next two days". At the same time, he emphasized that he is optimistic about the prospects of reaching a compromise. In anticipation of the next round of negotiations, assistants to the President of the United States and the Speaker of the lower house of Congress, Kevin McCarthy, began to form a "road map" to curb federal spending in order to resume negotiations on raising the debt ceiling.

The negotiations indeed took place - but ended in failure. The parties just "agreed to agree", but no more. Now the situation is up in the air. Another round of negotiations should take place after Biden completes his visit to Japan, where the G7 summit is being held. At the same time, the head of the White House canceled his planned visit to Australia, which speaks to the seriousness of the situation.

Important point: if the US President previously assessed the prospects of the negotiation process optimistically, today he has changed the tone of his rhetoric. For example, today he stated that declaring a default is "personally out of the question for him", but at the same time, he cannot guarantee that Republicans will not push the country into default by "doing something outrageous" (originally by Reuters agency - "Biden said he still believed he could reach a deal with Republicans, but could not guarantee that Republicans would not force a default by 'doing something outrageous'").

In this context, Biden called on Congress to work on the issue of raising the debt ceiling. He also emphasized that he would not agree to a bipartisan debt ceiling deal "exclusively on the terms of the Republicans". The head of the White House expressed readiness to cut spending, but stated that he does not intend to fulfill all the demands of Republican congressmen.

The terrifying word "default"

Judging by the escalation of the situation, a default no longer seems unthinkable. One can assume that Biden has decided to raise the stakes with his rhetoric before decisive negotiations, shifting the responsibility for possible default consequences onto the Republican party. However, in the context of currency traders' reaction, it doesn't really matter - whether it's a bluff or a real threat. Such statements from the President of the United States are capable of significantly shaking the markets. Considering that the aforementioned comments were made on a non-working day, dollar pair traders should prepare for a significant gap (in the case of the EUR/USD pair - a downward gap).

Overall, the upcoming week is packed with events. For example, on Monday, three representatives of the Federal Reserve (Bullard, Barkin, Bostic) will speak; on Tuesday, PMI indices will be published in Europe, and data on the volume of new home sales will be released in the US; on Wednesday, the minutes of the May meeting of the Federal Reserve are expected to be published along with a speech by ECB President Christine Lagarde; on Thursday, data on the volume of pending home sales will be disclosed in the States; and finally, on Friday, the most important inflation indicator - the core personal consumption expenditures index - will be published in the US.

But all these reports, as well as the speeches of representatives of the Federal Reserve and ECB, will remain in the shadow of the key topic of the upcoming week. The fate of the US national debt is the number 1 issue for dollar pair traders, so all eyes will be on the corresponding negotiations of American politicians. Especially since there is not much time left until the "hour X": as the US Treasury previously warned, on June 1, the country's government may declare a debt default if Congress cannot raise the debt ceiling.

Conclusions

Under such fundamental circumstances, it is extremely difficult to predict the possible trajectory of EUR/USD. It can only be assumed that at the start of the new trading week, risk-off sentiments in the markets will rise again, and this fact will provide significant support to the dollar. In this case, the pair will return to the area of the 7th figure with a target at 1.0700. But everything will depend on the negotiation capabilities of Republicans and Democrats. If they do find common ground and announce an increase in the debt ceiling, the spring will unwind in the opposite direction - against the American currency (especially in light of Jerome Powell's recent statements). If the negotiation saga drags on until next weekend, the dollar will continue to gain momentum, acting as a beneficiary of panic sentiments.

Considering the previous statements of Republicans, Democrats, and Biden himself, the negotiations will be very challenging - therefore, dollar pairs may once again find themselves in the area of price turbulence.

Analysis are provided by InstaForex

Read More

https://ifxpr.com/3MocOh2