Theresa May's European voyage: a difficult evening for the pound

Company does not offer investment advice and the analysis performed does not guarantee results

So, the epic with Brexit continues: today Theresa May arrived in Brussels, where two important meetings will be held in the evening - first, she will discuss the prospects of the "divorce process" with the President of the European Council Donald Tusk, and then – with the head of the European Commission Jean-Claude Juncker. According to some information, May will also meet with German Chancellor Angela Merkel.

The British Prime Minister is trying to find a way out of the current impasse: the "maximum" task at the moment is to agree with Europeans on the final date of the back-stop, while receiving the corresponding guarantees of a legal nature. Let me remind you that the main stumbling block in the British Parliament was precisely the Irish border discussion. According to the draft agreement, the special customs status of Northern Ireland does not have a time limit, which means it can become permanent. Moreover, according to the provisions of the transaction, London will not be able to waive this status unilaterally. Such vague prospects were perceived in hostility by the laborists, unionists, and the "hawkish wing" of conservatives.

According to Theresa May, the majority of deputies support the key points of the deal, but the uncertainty with backstop forces them to vote against the proposed agreement. In turn, Labour states that the problem lies not only in backstop but also in many other aspects. However, conservatives and unionists voice more restrained comments. Thus, the chances of a "soft" Brexit are still there – and this explains the current dynamics of the pound, which paired with the dollar, consolidated at the bottom of the 26th figure.

By and large, now the "ball" is on the side of Europe. If Brussels makes concessions and fixes the final date of the backstop, many British MPs may reconsider their decision in favor of the proposed deal. However, the other scale – the disastrous consequences of "hard" Brexit, which have already been said about.

However, Europe is not in a hurry to meet. At least, the head of the European Council Donald Tusk today said that Brussels will not re-discuss the agreement reached, and even more so will not revise the issue of the Irish border. Nevertheless, the head of the EC said that the European side is ready to think about how to "facilitate the process of ratification by the British side." What exactly Donald Tusk had in mind is unknown, so his words can be interpreted in a fairly broad sense. The head of the European Commission Juncker, in turn, also rejected the hypothetical revision of the transaction. However, he admitted the possibility of a certain compromise: speaking at the session of the European Parliament, Juncker said that in the current situation, certain clarifications are permissible – but without revision of the text of the Treaty.

In other words, on the one hand, Brussels categorically refuses to revise the agreement, but on the other hand, it makes it clear that it is ready to make certain concessions in the context of clarifying and interpreting the agreements reached.

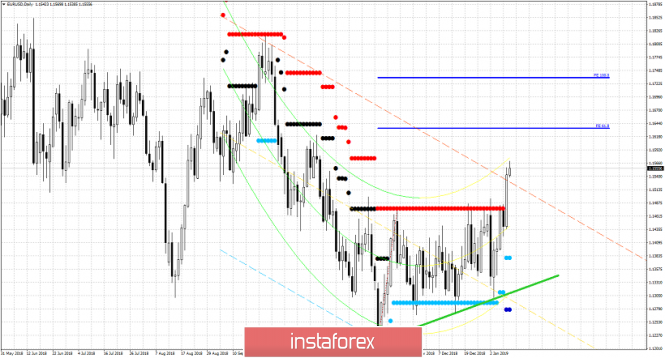

Thus, traders of the pound/dollar pair once again find themselves in agonizing wait: if today the parties do not sound positive signals, the price will collapse once again to an annual low, to the level of 1,2505. If the evening meetings lead to any result (even if of a preliminary nature), the bulls of the pair will seize the initiative and the price will rapidly go up.

The fact is that the GBP/USD pair has a strong unrealized potential for large-scale corrective growth, especially after today's release of data on the UK labor market. The unemployment rate remained unchanged, a record low of 4.1%, but the average earnings jumped by 3.3%, while experts expected a more modest growth – up to three percent. But the increase in salaries in nominal terms for three months was the strongest in the last ten years. The growth of applications for unemployment benefits was a bit disappointing, but the indicator of earnings plays a more important role in this context. Weak wage growth rates for a long time worried the members of the British regulator – in their opinion, this indicator largely determines the stability of inflation growth in the country. But the figures published today show that Average Earnings Index has been growing for the fourth month in a row, exceeding the forecast values.

All this allows the Bank of England to toughen its rhetoric and take a more "hawkish" stance at the next meeting, taking into account the growth of the consumer price index. If not for one "but" - Brexit. If London and Brussels are unable to agree on legal guarantees for the completion of the backstop, the probability of a chaotic Brexit will increase again, and the British Central Bank, in turn, will take a wait-and-see position for a long time - and under certain conditions, will reduce the rate. Therefore, the results of the next negotiations can not be overestimated: not only the fate of the deal depends on them, but also the prospects of monetary policy in Britain.

Analysis are provided by InstaForex